Individual vs Corporate SMSF Trustees

What is the difference?

An individual trustee is simply an individual person who manages a trust. The current laws governing SMSFs stipulate that even a single member SMSF with an individual trustee must have another person come on-board to act as a second trustee.

A corporate trustee is a registered company that acts as trustee of a trust.

86% of SMSF accounts are set up as Corporate trustee, why are people choosing corporate?

A corporate trustee SMSF can provide a greater level of asset protection than the individual trustee type, because doing so separates risk from assets. For this reason, the corporate trustee type is often preferred by lenders.

| Individual Trustee | Corporate Trustee | |

| Must have two trustees | Single member fund | Sole Director company |

| Each member of the fund must be a trustee | Multiple member fund | Each member of the fund must be a director of the corporate trustee |

| Not required | Director identification number | Required |

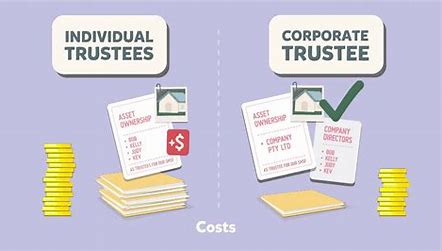

| No ASIC fee | Cost | ASIC charges a registration fee and annual review fee |

| The individual trustees | Asset owner | The corporate trustee |

| Change the name of the ownership of the asset | Change in SMSF fund members | Asset ownership remains unchanged. Directorship changes. |

| Greater care to ensure the separation of assets from personal name | Separation of assets | Provides clear separation of assets |

| Levied on each trustee (multiple penalties) | Administrative penalties | Levied on the corporate trustee |

| Yes | Regulated loan | No |

As specialist SMSF Finance Brokers, we at all times utilise about 5 SMSF lenders to ensure you have the best SMSF product at that time of loan submission, so please reach out to use – we’re here to help!

Leave a Reply

Want to join the discussion?Feel free to contribute!